Fintech & Payment Innovation

Insurance Software Development & Insurtech Solutions

We build modern insurance software development solutions that help carriers, brokers, and insurtech companies accelerate digital transformation. Our platforms support automated claims processing, AI-driven underwriting, real-time policy management, mobile-first customer engagement, and secure, compliant data architecture. Whether you need to modernize legacy systems, launch a digital claims portal, or develop a new insurtech product, our global engineering teams deliver high-quality, scalable, and measurable results for insurers across the US and Europe.

联络我们Insurance software solutions across the lifecycle

Compliance and security

Policy management platforms

Data analytics &

predictive modelling

Claims workflow automation

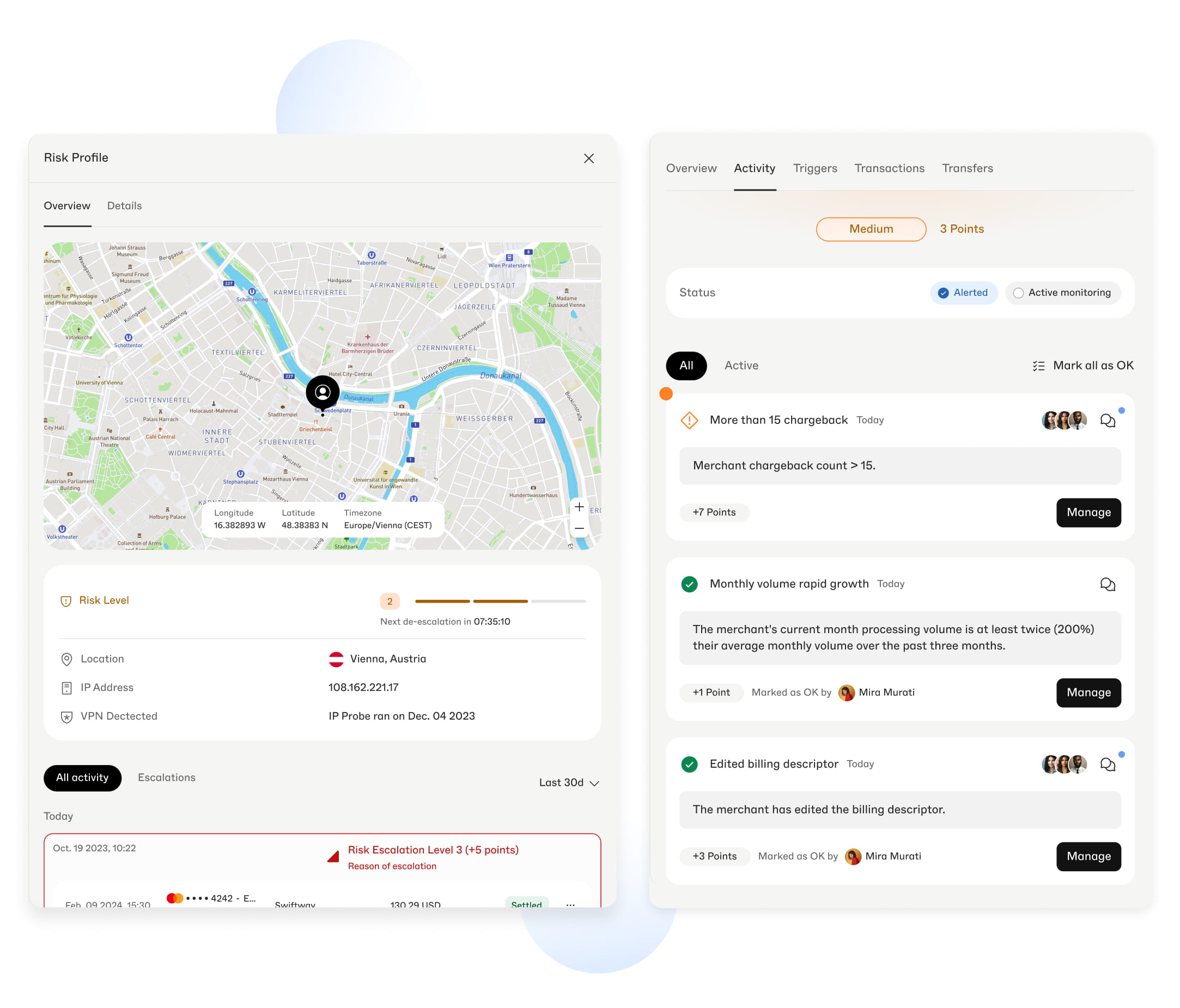

Fraud detection

& risk analytics

Blockchain & smart contract automation

云基础设施

Customer engagement platforms

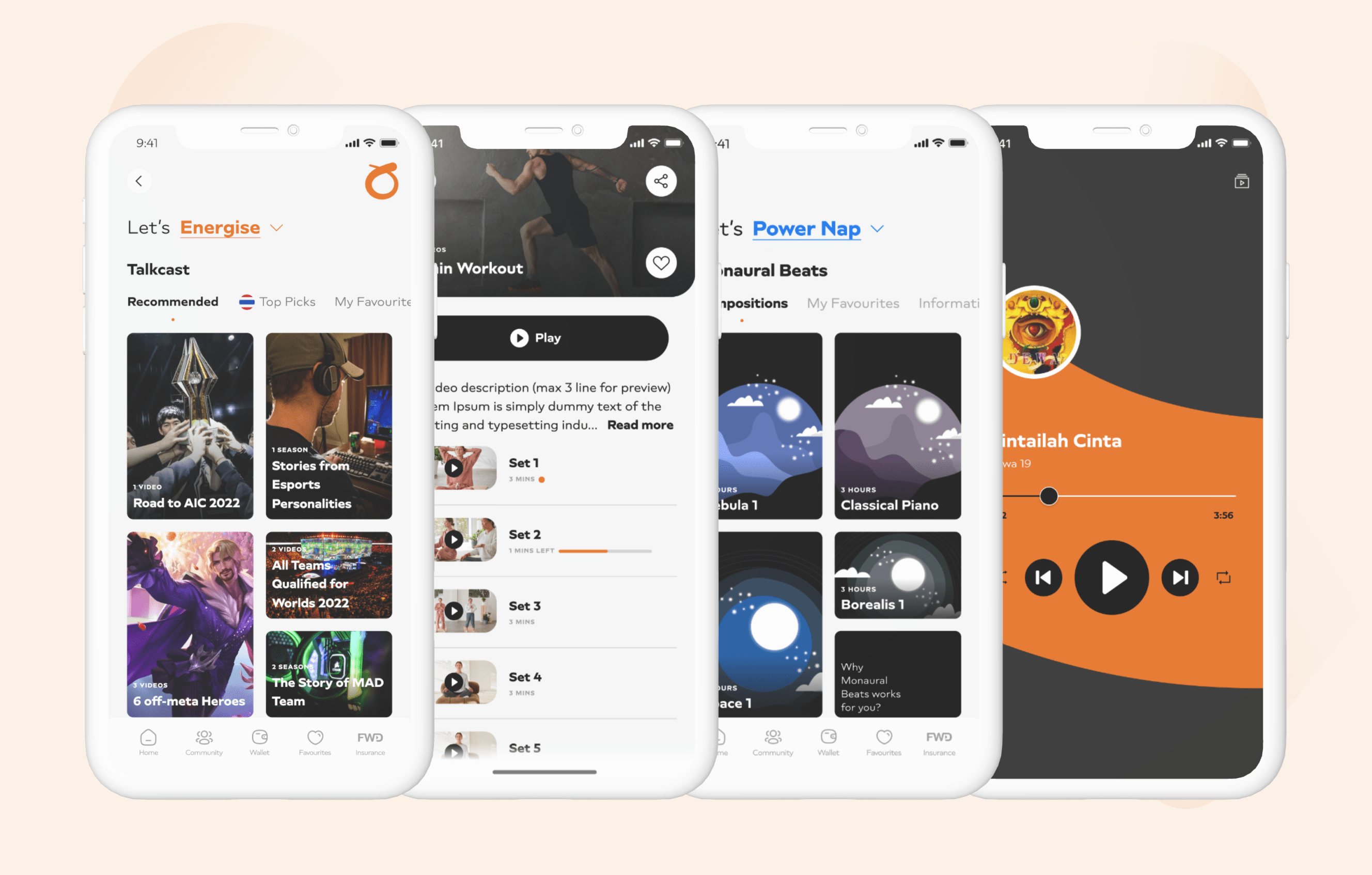

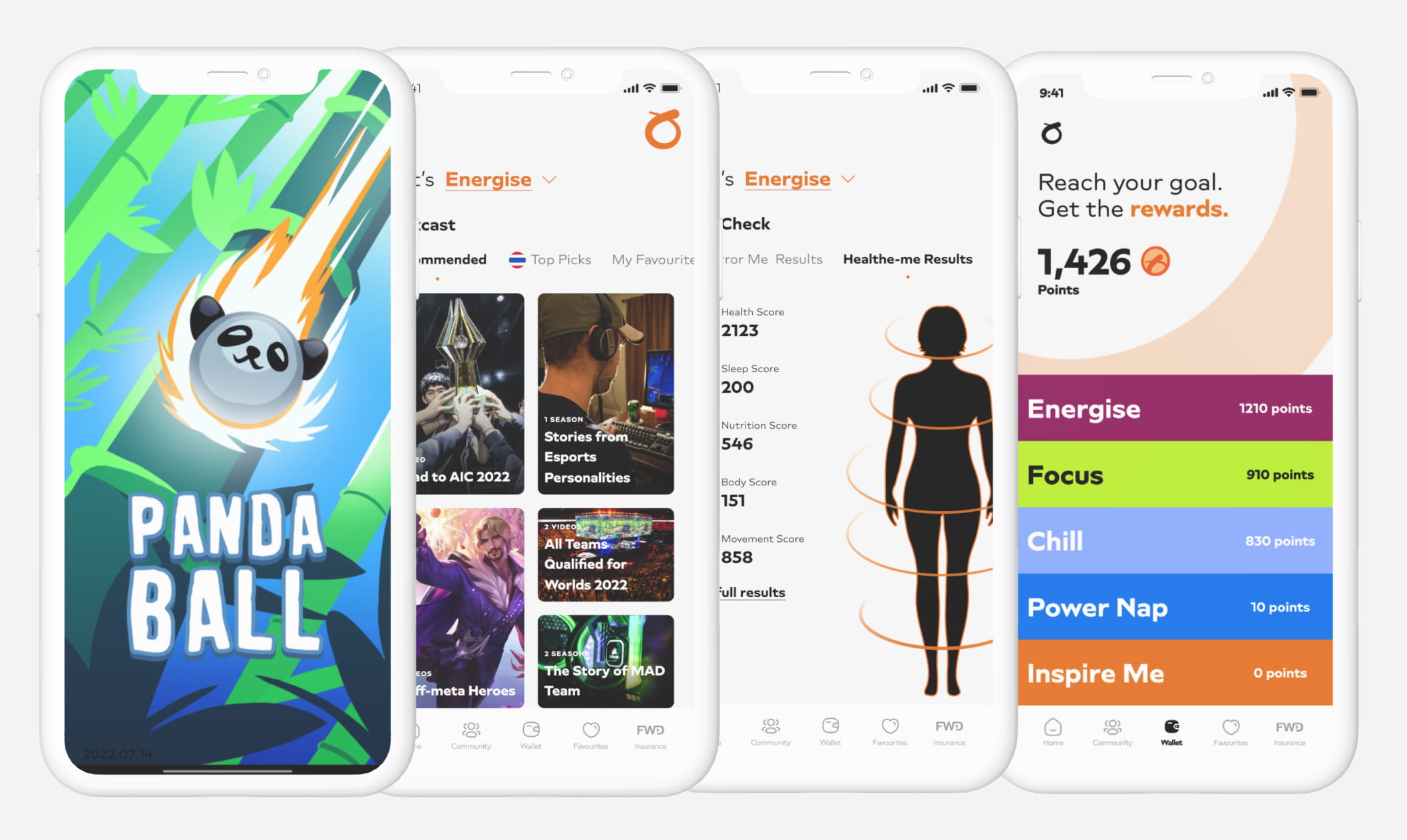

Omne is a lifestyle super app that boosts customer engagement through health tracking, insurance tools, mini-games, music streaming, and gamified rewards.

问题

解决方案

结果

1M +

10M

"我的团队没有使用 REact Native 的经验,而 Lasting Dynamics 为项目提供了开发人员和良好的构建框架、跟踪以及关于如何改进工作和流程的建议"。

"在 10 个冲刺阶段完成了 100% 个测试用例。全部为高质量,0 回归"。

FWD 总监

Upholding data protection and privacy standards

符合PCI DSS标准:

符合 SOC 2 合规标准

符合GDPR标准:

Customer engagement

& experience modules

Redefining engagement through lifestyle-driven insurance

We developed an all-in-one super-app that blends insurance, wellness, entertainment, content, and gamified rewards, increasing retention and creating long-term

Gamification & challenges

Streaming & content integration

Health tracking & rewards

Digital wallet integration

灵活、模块化、有吸引力

利用模块化白标移动应用程序吸引和留住用户

Modules can include AI-powered health tools, wellness tracking, mini-games, streaming content, reward systems, and digital insurance services. This flexible design enables insurers to launch rich mobile experiences quickly while maintaining security, scalability, and long-term user loyalty.

Data analytics &

predictive modelling

Turning raw data into powerful foresight

Interoperability & modern technology stack

Data management & APIs

AI & analytics frameworks

Modular microservices & cloud infrastructure

Front‑end frameworks

Blockchain & Smart Contracts

Trust, transparency, and automation for the insurance future

行业专长

Why choose Lasting Dynamics?

Multivendor management

We coordinated more than ten vendors across design, QA, engineering, and data operations, ensuring seamless collaboration across continents. Clear communication and agile orchestration turned a complex ecosystem into an efficient, unified delivery pipeline.

Speed, scale, and impact

From concept to market in just six months, we built Omne - a super-app that surpassed 10 million downloads and redefined engagement standards in the insurance industry. Our delivery speed enables insurers to launch products faster and respond to market demands in real time.

Global timezone advantage

Our distributed presence provides up to 16 hours of continuous development per day. This accelerates delivery, shortens release cycles, and maintains momentum around the clock - an essential competitive advantage for fast-moving insurance teams.

Exceptional support & maintenance

We don’t stop at launch. Our dedicated support engineers work seven days a week, ensuring platform stability, uptime, and ongoing performance optimisation. Insurers rely on us for long-term quality and dependable operations.

Full lifecycle services

From discovery workshops and UI/UX design to engineering, testing, deployment, and ongoing support, we manage the entire software lifecycle. Insurance teams can stay focused on their core business while we handle the technology that powers it.

Let’s redefine the future of insurance.

Our approach to custom software development

Questions about insurance software development

How long does it take to develop an insurance platform?

Timelines vary by complexity, but an MVP can be delivered in 4–6 months, with full roll-out in 9–12 months. Our agile delivery approach releases incremental value along the way, so you start seeing results early.

Can you integrate a new platform with our legacy policy and claims systems?

Yes. We routinely integrate modern platforms with legacy policy, billing and claims systems through APIs, data connectors and secure middleware. This preserves existing workflows while enabling modern features and automation.

What are the costs of developing custom insurance software?

Costs depend on features, integrations, security requirements and engineering effort. Simple modules may start in the lower range, while enterprise-grade platforms with AI, automation or multi-region compliance typically require a higher investment.

How do you ensure data privacy, security, and regulatory compliance?

We design platforms aligned with PCI DSS, SOC 2 and GDPR requirements. Encryption, access control, audit logging and secure cloud architectures ensure data integrity and compliance across all insurance workflows.

How does automated claims processing work?

Automated underwriting evaluates risk using predefined rules, historical data and machine-learning models. It speeds up decisions, improves consistency and allows underwriters to focus on complex cases rather than repetitive assessments.

How does insurance data analytics improve decision-making?

Insurance data analytics consolidates operational, customer, and claims data to identify risk patterns, pricing opportunities, and performance trends. This enables insurers to make faster, more accurate decisions across underwriting, claims, and portfolio management.