Crafting Excellence in Software

Let’s build something extraordinary together.

Rely on Lasting Dynamics for unparalleled software quality.

Luis Lambert

Jan 09, 2026 • 10 min read

In 2026, banks are facing a crossroads, invest wisely in smart tech and surge ahead, or risk falling behind as complexity, costs, and customer expectations continue to grow. Smart technology isn’t about chasing every trend, it’s about making strategic choices that remove friction, empower staff, and deliver seamless experiences for customers. The right tech helps banks stay agile, letting them respond quickly to market changes without getting bogged down in complicated systems.

A smart approach means prioritizing solutions that are easy to use, scalable, and adaptable. For example, tools that automate repetitive tasks or provide real-time insights free up employees to focus on higher-value work, like building customer relationships or designing new financial products. It’s not just about efficiency, it’s about creating an environment where both staff and customers feel supported, confident, and connected.

Thoughtful investment in smart tech is the difference between thriving and merely surviving in a fast-moving industry. Banks that focus on clarity, usability, and long-term value can avoid technical debt, reduce operational headaches, and unlock new opportunities. In a world where change is constant and expectations are sky-high, smart tech isn’t a luxury, it’s a necessity for any bank that wants to lead rather than follow.

Easier life using smart tech for business. Photo by Mikhail Nilov on Pexels: https://www.pexels.com/photo/man-person-cup-hand-7534804/

Smart tech is only “smart” if it moves your business forward. In 2026, the best banks aren’t the ones with the flashiest tools, they’re the ones whose technology choices are rooted in strategy. Before any investment, leading financial institutions map tech decisions directly to business objectives: customer growth, operational efficiency, regulatory compliance, or new service launches.

For example, if a bank’s goal is to expand its digital customer base, investing in mobile-first platforms and AI-powered onboarding makes sense. If cost reduction is key, automation and process optimization come to the fore. The crucial step is to avoid shiny-object syndrome and instead ask: “How will this tech drive measurable results for our bank, our staff, and our customers?”

Banks that align IT initiatives with enterprise strategy see better adoption, faster ROI, and less wasted effort. This alignment also makes it easier to secure executive buy-in and track the impact of every tech dollar spent.

Complex systems create unnecessary frustration, which has not value. In 2026, smart tech investments are all about simplicity, tools that are intuitive, require minimal training, and genuinely make work easier. This applies to both customer-facing apps and internal systems.

Banks have learned that the best solutions are those staff can start using quickly, with clear interfaces and seamless workflows. When technology is easy to adopt, staff morale improves, onboarding times drop, and errors are reduced. Customers also notice the difference, simple, fast digital experiences keep them loyal and coming back.

A focus on simplicity also minimizes the risk of costly implementation failures. Instead of overwhelming teams with features they don’t need, banks are choosing modular, scalable solutions that can grow with their needs. This “keep it simple” mantra is the foundation for sustainable digital transformation.

The pace of change in banking is relentless. Today’s solution must be able to handle tomorrow’s challenges, whether that means a sudden surge in users, regulatory updates, or new product rollouts. Smart banks invest in scalable technologies that can flex as demands shift.

Cloud-native platforms, microservices architectures, and API-driven ecosystems allow banks to add new capabilities, expand capacity, or integrate third-party services without major disruption. This flexibility reduces long-term costs by avoiding the need for frequent “rip and replace” overhauls.

In practice, scalability means a bank can onboard 10,000 customers this month or 100,000 next year, with the same core platform. It means launching a new lending product in weeks, not months. A future-proofed tech stack is the backbone of continuous innovation.

Security isn’t just an IT issue, it’s a core business priority. In 2026, the smartest tech investments are those that embed security and compliance from day one. With ever-stricter regulations and more sophisticated threats, banks need solutions that safeguard data, ensure privacy, and support auditability without slowing down operations.

Modern smart tech comes with built-in encryption, access controls, and automated compliance checks. Solutions that support global standards like GDPR, PSD2, and local banking laws reduce legal risk and make it easier to expand into new markets.

Proactive banks also use AI-driven security tools to detect anomalies, prevent fraud, and respond to incidents in real time.

Investing in robust security isn’t just about avoiding fines, it’s about building customer trust and protecting the brand’s reputation for the long haul.

Smart tech should amplify what people do best, not replace them. Automating repetitive, manual tasks, like KYC checks, loan processing, or report generation, frees up staff to focus on customer engagement, relationship building, and innovation. By taking routine work off employees’ plates, banks create space for creativity and problem-solving, turning human potential into a real competitive advantage.

In 2026, automation isn’t limited to back-office workflows. Customer self-service portals, chatbots, and automated onboarding systems are now table stakes. These solutions reduce wait times, eliminate errors, and provide the 24/7 support customers increasingly expect. By integrating these tools into everyday operations, banks can deliver faster, more accurate, and more personalized service.

Let’s build something extraordinary together.

Rely on Lasting Dynamics for unparalleled software quality.

Banks that invest wisely in automation gain a double benefit: happier customers and more productive employees. Operations can scale without proportionally increasing headcount, driving both cost savings and higher value across the organization. When staff are freed from repetitive tasks, they can focus on what truly matters, building relationships, designing better products, and contributing to a culture of continuous improvement.

Smart tech investment brings new opportunities. Photo by Yan Krukau a on Pexels: https://www.pexels.com/photo/hands-holding-smartphone-and-writing-on-table-with-charts-at-office-7693696/

Data is the fuel of modern banking, but only when it is transformed into actionable insights. Smart tech investments harness AI and analytics to turn raw information into clear guidance for decision-making. This includes real-time dashboards, predictive analytics, and machine learning models that support decisions across risk management, marketing, and operational strategy.

Banks using AI-powered analytics can detect fraud more quickly, forecast demand with greater accuracy, and tailor offers to individual customers. By leveraging these insights, they make smarter lending decisions, optimize cross-selling opportunities, and improve compliance with regulatory requirements. Data-driven intelligence becomes not just a support function, but a central component of competitive advantage.

The best part? Modern AI platforms are increasingly accessible. Banks no longer need an army of data scientists to extract value, team members at all levels can leverage AI tools to make informed, timely decisions. With the right technology in place, every employee becomes empowered to act on insights, driving faster, smarter, and more consistent outcomes across the organization.

No bank operates in a vacuum. Smart tech investments are those that play well with others, systems that can integrate easily with existing infrastructure and external partners. Open APIs, standardized data formats, and modular architectures are essential.

Banks that prioritize integration avoid the dreaded “tech spaghetti” of disconnected tools. They’re able to connect to fintech partners, regulatory bodies, and core banking systems with minimal friction. This ecosystem approach supports rapid innovation, as banks can quickly plug in new services or switch out underperforming vendors.

A well-integrated tech stack also reduces operational risk, since data flows smoothly and consistently across the organization.

Technical debt is the silent killer of digital progress. It’s what happens when banks patch together outdated systems, skip documentation, or delay upgrades to “save time.” In 2026, smart tech investment means facing tech debt head-on, auditing existing systems, decommissioning obsolete tools, and establishing clear upgrade paths.

Banks that actively manage technical debt enjoy faster deployments, lower maintenance costs, and fewer security vulnerabilities. They’re able to innovate confidently, knowing their foundations are solid.

Smart tech strategies include regular code reviews, standardized development practices, and a commitment to ongoing modernization. By keeping the tech stack lean and current, banks avoid costly surprises and keep their teams focused on building the future, not fixing the past.

The heart of smart tech investment is always the customer. In 2026, banks are competing on experience, how easy, fast, and satisfying it is for people to manage their money, get support, or try new services. Every technology decision should be filtered through the lens of user experience.

This means intuitive mobile apps, transparent communication, seamless onboarding, and frictionless digital journeys. Personalization powered by AI helps banks anticipate needs and deliver offers that resonate.

Customer-centric banks measure success not just by downloads or logins, but by satisfaction, loyalty, and advocacy. The smartest tech investments are those that turn customers into fans, fueling organic growth through exceptional service.

Even the smartest banks can’t do it all alone. Navigating the ever-changing tech landscape, making the right investment decisions, and avoiding costly missteps requires trusted partners who understand both banking and the realities of smart technology. Leading banks recognize that success comes from collaboration, working with experts who bring experience, insight, and practical know-how to every stage of a project.

From idea to launch, we craft scalable software tailored to your business needs.

Partner with us to accelerate your growth.

A strong partner supports not just implementation, but the full journey, strategy, change management, and ongoing optimization. They help banks align technology with business goals, share industry best practices, and keep teams up to speed on emerging trends. By providing specialized talent and scalable solutions, these partners allow banks to move quickly, reduce risk, and maximize the return on every tech investment.

Choosing the right technology partner can be the difference between stalled projects and successful digital transformation. Banks that invest in these relationships gain access to guidance, expertise, and resources that empower them to innovate with confidence. With the right support, technology becomes more than a tool, it becomes a strategic advantage that drives growth, efficiency, and better experiences for both staff and customers.

For us at Lasting Dynamics, smart tech investment is not just a trend, it’s a fundamental aspect of how we work. We’ve seen firsthand how the right technology can create value and stronger connections. A great example is OMNE, a lifestyle app where we combined health, insurance, rewards, and entertainment into a single experience. It shows how banks and financial companies can move beyond basic tools and build platforms people actually enjoy using every day.

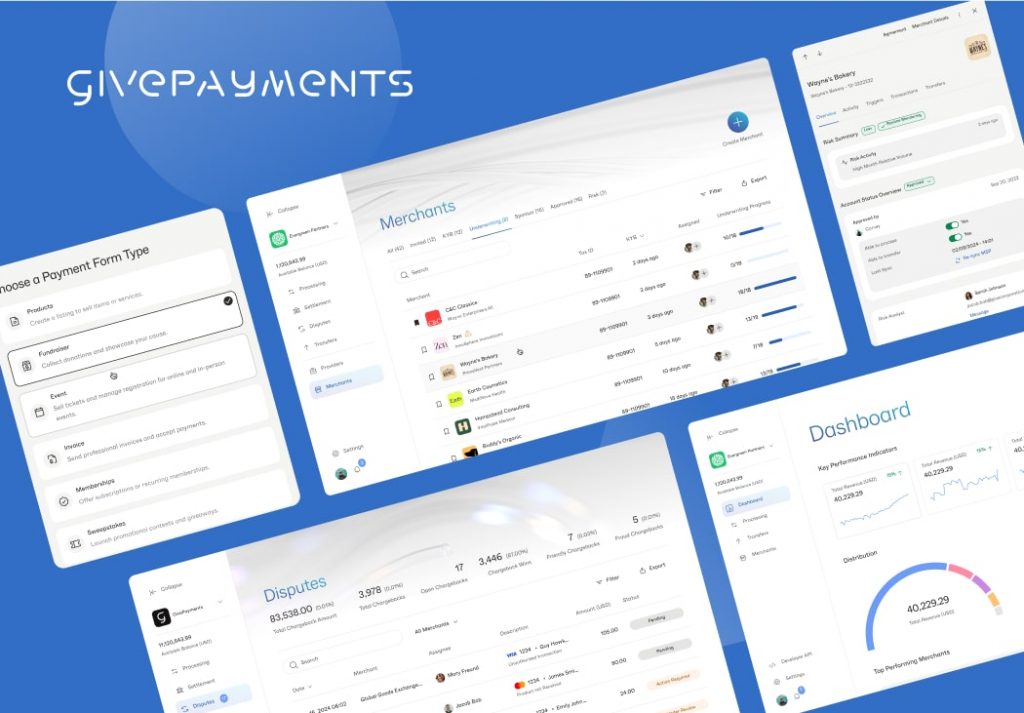

We also worked on GivePayments, a project focused on making digital transactions faster, safer, and easier to manage. Our goal was simple, create a solution that helps businesses and their customers trust every payment, while keeping things smooth and accessible. It’s another way we bring smart technology into the financial world in a way that feels practical and human.

In every project, we make sure to get the most out of the technology available, so that innovation translates into real impact. If you’d like to see more, we invite you to explore our section on Finance, Banking, and Insurance, where we share more about OMNE, GivePayments, and other stories. We believe everyone deserves access to better financial services, and the only way to build that future is by working together to make it happen.

Smart tech investment is the foundation of banking growth in 2026. By focusing on strategic alignment, simplicity, scalability, security, automation, analytics, integration, and customer-centricity, banks can turn technology into a true enabler of business success. Thoughtful investment allows institutions to avoid the common pitfalls of technical debt, minimize operational risk, and build systems that are robust yet flexible enough to adapt as the market evolves.

The impact goes beyond efficiency and cost savings. By using smart technology to streamline operations, empower staff, and gain actionable insights, banks can deliver the seamless, personalized experiences that customers increasingly expect. Automation, AI-driven analytics, and integrated platforms help organizations make faster, smarter decisions, while also giving employees the tools and time to focus on meaningful, value-added work.

Ultimately, the future belongs to those who invest wisely. Banks that combine the right technology with strong partnerships and a clear strategy will not only stay competitive, they will lead. By embracing smart tech in a thoughtful and deliberate way, organizations can grow with confidence, respond to change proactively, and create lasting value for customers, employees, and stakeholders alike.

Ready to make smart tech investment your bank’s growth engine for this 2026? 👉 Contact Lasting Dynamics today, let’s create digital solutions that are simple, scalable, and built for lasting success.

We design and build high-quality digital products that stand out.

Reliability, performance, and innovation at every step.

Smart tech investment means choosing technology that is simple, scalable, secure, and aligned with business goals, helping banks grow efficiently and avoid unnecessary complexity.

Simple, user-friendly platforms drive faster adoption, reduce training time, minimize errors, and boost both staff and customer satisfaction.

By regularly auditing existing systems, decommissioning outdated tools, enforcing coding standards, and partnering with experienced tech consultants for ongoing modernization.

It’s central, banks must design digital experiences around real user needs, ensuring every new tool or process reduces friction and builds customer loyalty.

We provide strategy, implementation, and support for banking tech projects, ensuring every investment is secure, scalable, and delivers measurable business value.

Transform bold ideas into powerful applications.

Let’s create software that makes an impact together.

Luis Lambert

I’m a multimedia designer, copywriter, and marketing professional. Actively seeking new challenges to challenge my skills and grow professionally.